Are you considering buying a home in Israel or the US? If so, it’s important to understand the differences between the mortgage process in these two countries.

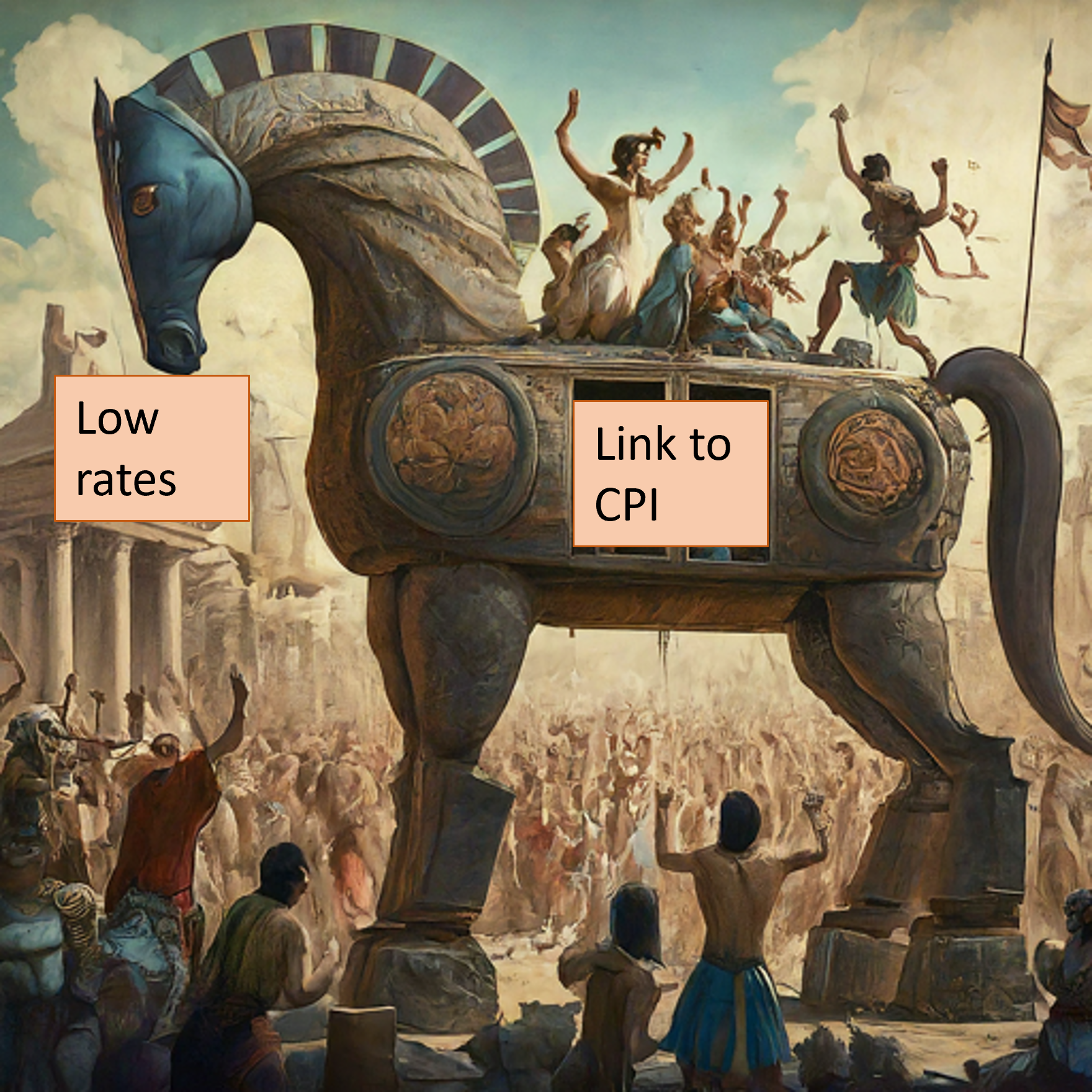

Beware the Trap: The Deceptive Allure of CPI-Linked Mortgages in Israel

Entering the realm of real estate investment can feel like tackling a daunting maze, where hidden traps lurk beneath the surface. In Israel’s mortgage market, one such trap lies in the guise of CPI-linked mortgages, promising low initial payments but concealing long-term risks.

Deciphering the Deception: CPI-Linked Mortgages Exposed

While North America favors fixed-rate and adjustable-rate mortgages, Israel introduces a different player: CPI-linked mortgages. These mortgages adjust their principal balance based on changes in the Consumer Price Index (CPI), initially seeming like a bargain but potentially leading to higher costs over time.

Facing the Reality: Long-Term Consequences

Don’t be fooled by the illusion of affordability. Despite the initial appeal of low rates, CPI-linked mortgages often result in greater expenses down the line. As inflation creeps in, so does the burden of increased principal balances, gradually escalating the overall cost of the mortgage.

Exploring the Pitfalls: Proceed with Caution

Amidst the labyrinth of mortgage options, CPI-linked mortgages offer a false sense of security. While they boast lower early payment fees, the long-term financial implications can be daunting. Falling into this trap without fully grasping the risks can spell financial disaster.

Conclusion: Navigate Wisely, Craft Your Ideal Mortgage

In the complex landscape of real estate financing, CPI-linked mortgages in Israel pose a formidable challenge. However, by understanding the true cost and implications, investors can craft a mortgage tailored to their needs, ensuring it aligns with their long-term financial goals while avoiding the pitfalls hidden within CPI-linked mortgages.

Leave A Comment